Checkout Counter Displays: The Complete Guide to Last-Chance Merchandising That Drives Revenue

Here’s the frustrating reality: checkout counter displays occupy a small fraction of total retail floor space, yet the majority of brands and retailers treat these front-end displays like an afterthought. Retailers stack generic candy racks next to the register, dump leftover inventory in a wire basket, and call checkout merchandising complete. Meanwhile, the companies that actually think strategically about this zone often see 5-15% lifts in average transaction value from the same square footage, with some implementations achieving higher. Note that pricing, regulations, and market conditions change frequently. Verify current information before making investment decisions.

This guide skips the generic ‘impulse buy tips’ you’ve read a hundred times. If your register zone is bleeding money, we’ll show you how to fix it.. Instead, you’ll get what retail professionals actually need: a framework for designing, selecting, and deploying checkout merchandising units that measurably increase revenue. We’ll cover which display configurations work for different retail formats, how to decide between custom and off-the-shelf solutions, what materials survive high-traffic checkout environments, and how to build a business case that justifies your display investment.

Why does checkout merchandising matter? Research shows that checkout displays boost last-minute sales significantly. Register displays meaningfully increase purchase decisions compared to in-aisle placement alone. That impact compounds when you consider that, according to industry surveys, the average American consumer spends thousands annually on impulse purchases, and a majority of shoppers say point-of-sale displays directly influenced their buying decisions. The checkout zone delivers disproportionate revenue per square foot. Most businesses just aren’t capturing it.

Partner with us for custom marketing solutions that captivate and engage.

What Are Checkout Counter Displays and Why Do They Matter?

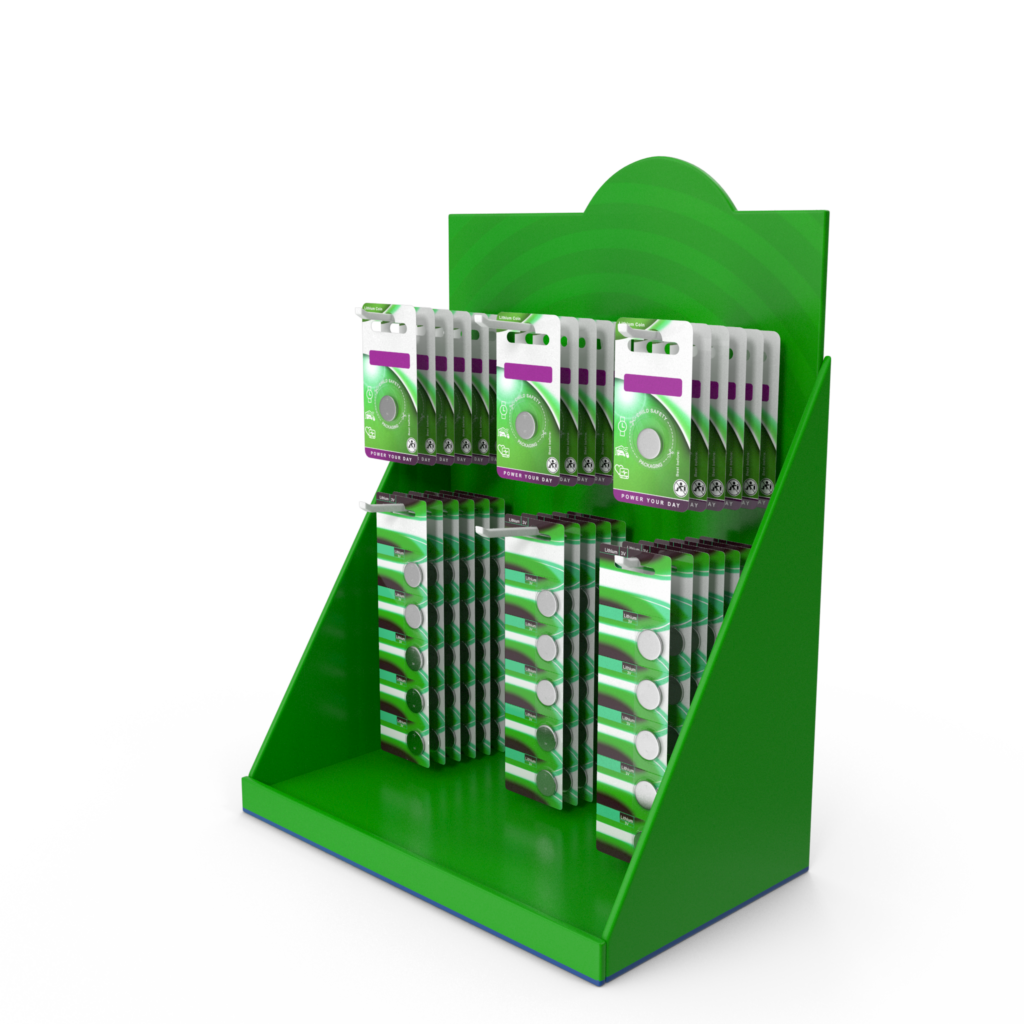

Checkout counter displays are point-of-purchase (POP) merchandising fixtures positioned at or near retail transaction areas to capture last-minute impulse purchases. These retail fixtures, including countertop units, floor-standing queue systems, and tiered risers, leverage the psychological moment when customers have their wallets out, and decision thresholds are lowest, making checkout displays ideal for driving incremental revenue.

The cash wrap (the retail industry term for the checkout counter area and its surrounding merchandising zone) represents the most valuable per-square-foot real estate in retail environments. At 3-5 square feet, a well-optimised cash wrap can generate an estimated $150-400 in incremental daily revenue for mid-volume retailers. That translates to potentially $50,000-$150,000 annually from space smaller than a bathroom stall, though individual results vary significantly based on store traffic, product selection, and execution.

Why are checkout displays more effective than in-aisle placement?

Checkout counter displays outperform in-aisle merchandising because shoppers have already committed to purchasing. The psychological barrier to adding a $3-$8 item drops dramatically once customers have decided to buy. Additionally, the captive dwell time (often 45-120 seconds waiting in line) creates uninterrupted exposure that in-aisle browsing rarely provides.

Here’s an unpopular opinion: the problem isn’t that retailers don’t know checkout displays work. Everyone knows that point-of-sale displays drive revenue. The problem is that most checkout merchandising is lazy. Dusty lip balm racks. Generic fixtures that look like every other store. That approach isn’t merchandising. That’s furniture.

Effective register displays do three things: they match the store’s brand presentation, they feature products specifically selected for last-minute purchases (items under $15 with universal appeal), and they’re designed to align with the actual traffic patterns and sightlines of that specific checkout configuration.

Types of Checkout Counter Displays: Matching Configuration to Retail Format

Checkout merchandising units come in several distinct configurations, and the biggest mistake retailers make is grabbing whatever’s cheapest without considering how the display fits their specific environment. If your register zone is bleeding money, the wrong display choice is often the culprit.

Countertop Displays for Limited Space

Countertop displays are compact merchandising units designed to sit directly on checkout counters, holding small, low-cost items in the $1.99-$12.99 range: travel-sized toiletries, candy, gift cards, phone accessories.

These work best when counter space is limited (under 4 square feet), and retailers need to maximise visibility without blocking the cashier-customer interaction. The optimal height is typically 12-18 inches, visible from 6-8 feet away, but not creating a barrier.

Standard countertop displays from generic suppliers generally run $35-$150, though quality varies dramatically. Verify current pricing with suppliers, as costs fluctuate with material prices and market conditions. Custom countertop displays from specialised manufacturers typically start around $150-$400 per unit and offer significantly better durability and brand presentation.

Floor-Standing Displays for High-Traffic Zones

Floor-standing checkout displays are freestanding retail fixtures positioned near registers, offering greater product capacity (often 15-50+ product facings versus 6-12 for countertop) while guiding customer flow through the checkout zone.

Queue merchandising (positioning displays along checkout lanes where customers wait) transforms idle dwell time into shopping moments. Floor-standing displays put products at eye level for the 45-120 seconds customers typically spend waiting at peak hours.

Floor-standing displays make sense for high-volume environments processing 200+ transactions daily, such as grocery stores, big-box retailers like Target and Walmart, and pharmacies like CVS and Walgreens. These displays typically cost $200-$1,200 plus 4-8 square feet of floor space, but a well-positioned floor-standing display can generate 800-1,500 impressions daily, compared with 200-400 for a countertop unit.

Choosing the Right Format for Your Store Type

Convenience stores: Floor-standing queue displays near the register (typically $180-$350), plus countertop displays for lotto, energy drinks, and accessories. High-turnover items with 40%+ margins work best.

Grocery stores: Full queue merchandising systems with 3-5 floor-standing units per lane (often $400-$800 per system). Grocery checkout is where display revenue scales. Major grocery chains generate billions annually from checkout-zone sales.

Speciality retail and boutiques: Countertop displays that match the store aesthetic ($150-$400). Generic wire racks look cheap in curated environments. Custom manufacturers specialise in countertop displays for premium retail.

Department stores: A mix of countertop for staffed registers (cosmetics, jewellery) and floor-standing units for high-traffic departments.

The mistake I see constantly: retailers using grocery-store-style queue merchandising where it doesn’t fit. That massive candy rack looks appropriate at Walmart. In your artisanal home-goods shop doing $400K annually, it looks desperate and costs brand equity more than it generates in impulse sales.

Design Principles That Maximise Checkout Display Performance

Visual merchandising (optimising retail presentation through space, colour, lighting, and arrangement) guides how checkout displays draw the eye. But most advice stays frustratingly vague. Let’s get specific.

Where should checkout displays be positioned for maximum visibility?

The prime visibility zone is 48-60 inches from the floor, roughly eye level for average North American adults. Countertop displays on a standard 36-inch counter put products at 48-54 inches, nearly optimal.

But here’s what most guides miss: sightlines matter. Displays can’t block customer-cashier views. A display taller than 18 inches on a standard counter creates barriers that can increase the opportunity for theft and extend transaction times. These barriers may also reduce customer satisfaction scores.

For floor-standing displays, products can range from 30-36 inches (for kids’ items, grab-and-go snacks) to 54-60 inches (for adult eye level). Tiered displays with 3-4 height levels create natural visual progression.

Quick sidebar on children’s products: put them low, 30-40 inches. Kids notice what’s at their eye level, and consumer research shows parents frequently yield to children’s checkout requests. It sounds manipulative because it is. But this is retail.

Balancing capacity with presentation: Displays should look 70-80% full. Consumer psychology research suggests that displays appearing partially stocked (rather than overstuffed) generate stronger sales, as visual breathing room makes products easier to evaluate and signals popularity without triggering scarcity anxiety.

Custom vs. Off-the-Shelf Checkout Displays: When to Invest

This is where most guides fail you. They say displays matter, then leave you to choose between a $75 generic wire rack and an $800 custom acrylic unit. Let’s make this useful.

When Generic Displays Make Sense

Testing new product categories: Before investing $500-$1,500 in custom displays, validate with a $45-$89 generic display for 60-90 days. Test first, invest after 8-12 weeks of sales data.

Brand presentation isn’t your differentiator: If you’re a convenience store competing on location and price, premium displays may not move the needle. Standard spinner racks ($65-$120) often work fine.

Low volume: Custom displays have upfront tooling costs (often $2,000-$5,000) that only make sense at scale. Under 50 locations? Generic is probably fine.

Temporary campaigns: Seasonal promotions, limited-time products. Corrugated displays typically run $8-$25 per unit at volume.

When Custom Displays Deliver ROI

Consumer packaged goods (CPG) brands frequently invest in custom checkout displays for snacks, beverages, and personal care items in partner retail locations. For 50+ display deployments, custom is usually worth considering:

Brand differentiation: Research suggests custom-branded displays generate stronger brand recall than generic fixtures, helping your products stand out in competitive checkout environments.

Exact-fit dimensions: Generic displays come in standard sizes. If your packaging is unusual (taller than 10″, curved bottles), generic displays waste 20-40% of space. Custom manufacturing using CNC machining and laser cutting allows precise engineering for any product dimension.

Durability at scale: That $75 generic display often falls apart after 3-4 months. A $350 custom display typically lasts 2-3 years. With over 500 stores, when you factor in replacement shipping and labour, the total cost of ownership often favours custom, though you should calculate your specific scenario.

Retailer requirements: Major retailers (Walmart, Target, Kroger) have display specifications that generic options can’t meet. Custom is often the only way to get premium checkout placement.

Materials and Durability: What Survives the Checkout Zone

Checkout displays take abuse. Customers bump them 40-60 times daily, roughly grab products, spill coffee, and knock displays over with shopping carts. Materials matter.

Acrylic: Clear, modern, excellent light transmission. Scratch-resistant with hard coating. Typically $150-$600 for countertop units. Often lasts 24-36 months with proper care. UV-stabilised acrylic extends life in high-light environments. Downside: can crack if thinner than 1/8″, may yellow near windows.

Metal (powder-coated steel/aluminium): Maximum durability, often 5-7 years. Typically $65-$200 for wire displays. Best for heavy-duty environments and security-conscious products. Downside: weight increases shipping costs by 25-40% and can feel industrial in boutique contexts.

Corrugated cardboard: Cost-effective (typically $8-$45 at volume), sustainable, ships flat. Good for campaigns under 90 days. Downside: usually 6-12 weeks before visible wear, can’t hold heavy products, warps in humidity.

Wood/MDF: Premium perception for artisan products. Typically $200-$800 for a countertop. Downside: 2-3x heavier than acrylic, requires lacquer finishing, not ideal for humid environments.

How long do checkout displays last?

Material lifespans vary significantly based on traffic, handling, and environment. General guidelines: Corrugated displays typically last 8-16 weeks in high-traffic environments. Acrylic often lasts 24-36 months with monthly cleaning (use acrylic-safe cleaners, not ammonia-based products). Metal may last 36-60 months. Wood typically lasts 24-48 months, depending on finish and humidity.

Here’s what nobody tells you: the cheapest displays often end up costing the most over time. A $50 corrugated display replaced every 8 weeks costs more annually than a $300 acrylic display lasting two years. Calculate the total cost of ownership, not just the upfront price.

The Business Case: ROI Framework for Checkout Displays

Average transaction value (ATV) is the key metric. Well-placed checkout displays may increase ATV by $1.50-$4.00 per transaction, often a 3-8% lift on a typical $50 basket. Individual results vary significantly based on product selection, store traffic, and execution.

What’s the typical ROI for checkout counter displays?

ROI varies widely, but here’s a sample calculation to illustrate potential returns: Custom countertop display ($400) + shipping ($35) + installation ($15) = $450 total investment. If the average checkout item price is $3.50 with 45% margin ($1.58 profit), and the display generates 85 additional units monthly, that’s approximately $134 incremental profit. Potential payback: 3-4 months. This is illustrative only. Your actual results will depend on your specific products, traffic, and execution.

Measuring ROI:

- Establish baseline (4-6 weeks): Track current ATV and checkout-zone purchase percentage

- Measure post-deployment (8-12 weeks): The longer period matters because the novelty effect can overstate early results

- Calculate cost-per-incremental-purchase, including shipping, labour, and replacement

- Compare to alternatives

Reality check: Many brands don’t measure checkout display performance at all. You may be flying blind with completely measurable outcomes. Even tracking pre/post ATV from your POS takes just minutes each week.

For Brand Marketers: Securing Checkout Placement

Checkout placement is premium real estate. Slotting fees at major grocery chains can run $15,000 to $40,000 annually or more, though rates vary by retailer and category. Approach accordingly.

Negotiate with data. Show specific performance numbers from test stores. Category managers make decisions based on economics, not relationships.

Meet retailer specifications exactly. Walmart requires a maximum 12″x18″ footprint, 24″ height, and UL certification for electrical components. Target requires planogram compliance and approved vendor lists. Miss any specification, and your display never gets placed.

Monitor compliance. Industry research suggests up to 40% of POP displays may be set up incorrectly or not at all. Budget for compliance monitoring via mystery shopping ($75-$150 per store visit, typically) or field team visits.

Calling out BS: Many brands expect retailers to prioritise their displays without providing value. Retailers allocate checkout space to whoever generates the most revenue per square foot. If your display underperforms competitors, you don’t get the space. Compete on economics, not hope.

How Much Do Checkout Counter Displays Cost?

Pricing varies by material, complexity, and volume. These ranges are approximate and change with market conditions. Verify current pricing with suppliers.

| Display Type | Typical Price Range | Best For |

| Generic countertop (wire/plastic) | $30-$150 | Testing (60-90 days), temporary campaigns |

| Mid-tier countertop (branded acrylic) | $150-$500 | Ongoing retail presence (12+ months) |

| Custom countertop (fully engineered) | $400-$1,500+ | Major brand deployments (100+ units) |

| Floor-standing queue displays | $200-$1,200 | High-traffic stores (300+ daily transactions) |

| Interactive/digital displays | $800-$5,000+ | Premium brand experiences |

Volume changes everything. A $600 custom display may drop to $180-$220 when 500 units are ordered. Always get quotes at your actual deployment volume.

When Should You Replace or Refresh Checkout Displays?

Replace displays when physical wear becomes visible, when display fatigue reduces effectiveness (often 6-12 months), or when brand packaging changes require updated graphics. Budget approximately 15-25% of the initial investment annually for replacement.

Physical wear indicators: Scratches covering a significant surface area, faded graphics, and wobbly construction. Research suggests damaged displays negatively impact purchase intent and brand perception.

Display fatigue: After 6-12 months, shoppers often stop seeing displays. The brain categorises familiar objects as background. Display effectiveness typically diminishes over time as shoppers become habituated to familiar fixtures. Even moving the display to a different checkout lane can reset attention.

Seasonal rotation: Sunscreen May-August, gift items November-December, candy around holidays. Plan 4-6 major rotations annually for seasonal product mix.

The Bottom Line

Checkout counter displays convert at disproportionate rates, often delivering 3-8% ATV lift, because they reach shoppers at their most purchase-ready moment. The difference between displays that drive results and displays that take up space comes down to three factors: matching configuration to retail format, investing in appropriate quality ($150+ for anything lasting 6+ months), and actually measuring performance.

Audit your checkout this week. Pull POS data and calculate average transaction values over 30 days (takes about 10 minutes). Spend 15 minutes observing customer behaviour during peak hours (11 AM-2 PM, 4-7 PM). Identify 3-5 product categories in the $3-$10 range with 40%+ margins that could benefit from last-chance visibility. Then evaluate whether current displays support or undermine your brand.

For brands placing displays in retail partners’ stores, start conversations about checkout placement now. Request specification documents (one email). Build your case with performance data. And invest in display quality reflecting your brand standards. The loss of brand equity may offset the short-term savings from cheap generic displays.

Pop49 has designed and manufactured custom displays for brands including Pepsi, IKEA, and Sol Cerveza since 1989 . Our in-house capabilities span concept design through CNC machining, laser cutting, and large-format printing, delivering displays engineered to your exact specifications. Contact our team to discuss your checkout merchandising goals and get a custom quote.

More Articles

What are Merchandising Displays

Discover how merchandising displays attract customers, boost sales, and transform retail spaces into engaging shopping experiences. Learn more today.

Plinko Promotions: Fun & Unpredictable Rewards

Discover the history of Plinko and how custom Plinko boards drive engagement at trade shows, events, and brand activations.

What Are Countertop Point-Of-Purchase Displays?

Discover how modular trade show booths can transform your event presence! Learn about their flexibility, cost savings, and customization for…